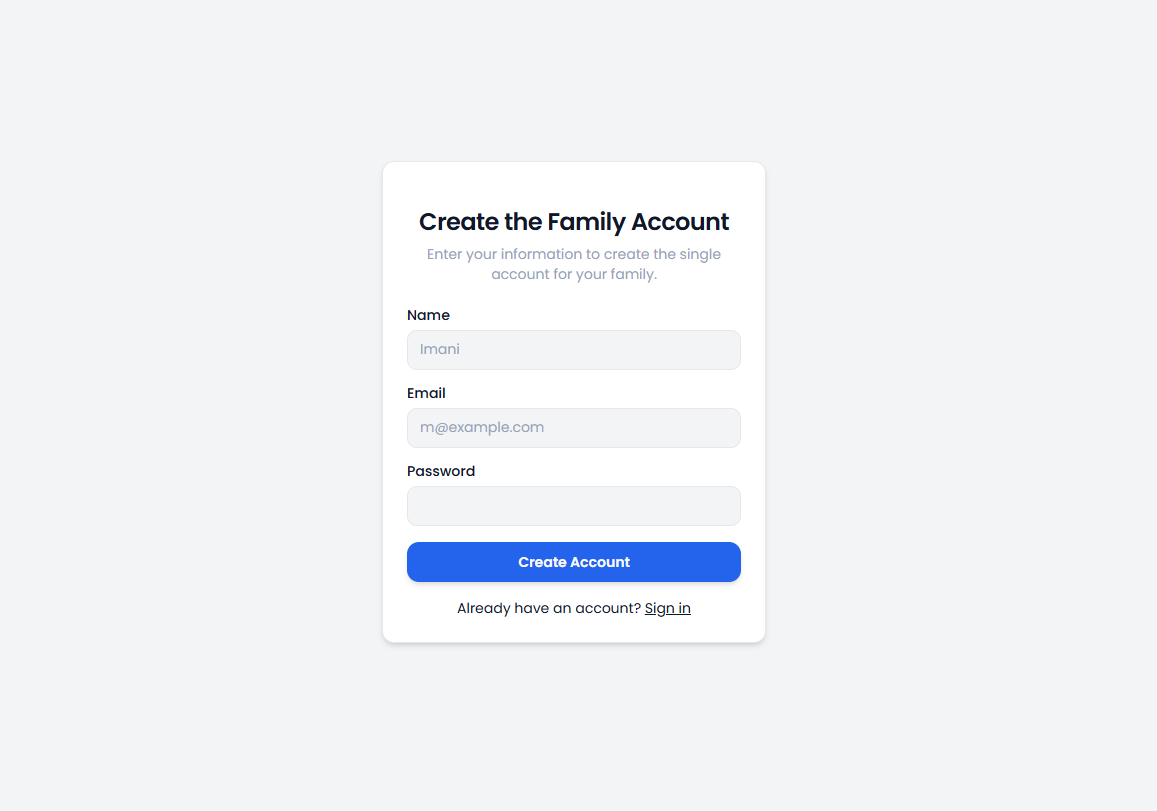

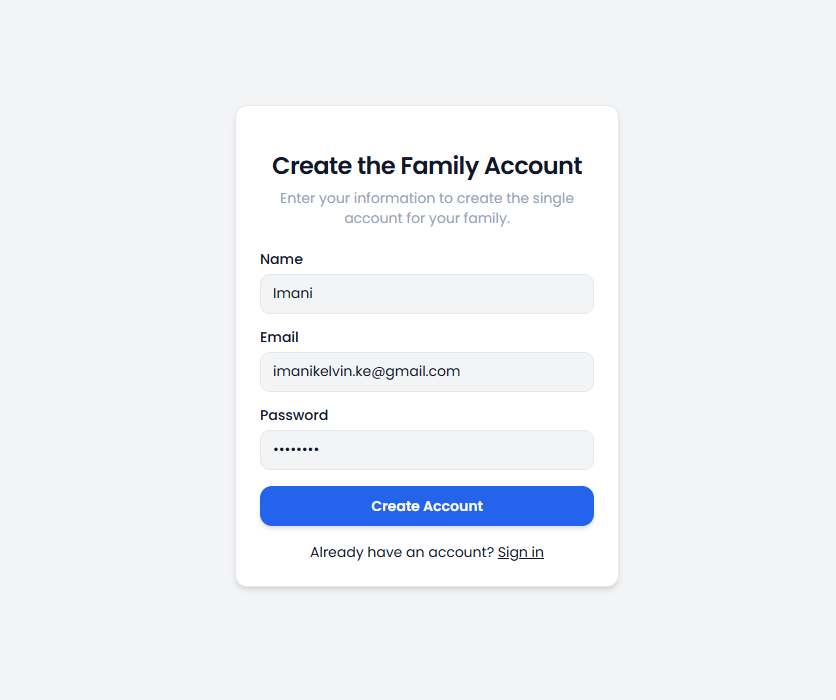

Sign Up

Start your journey by visiting the sign-up page. Enter your email address and create a secure password to establish your new account.

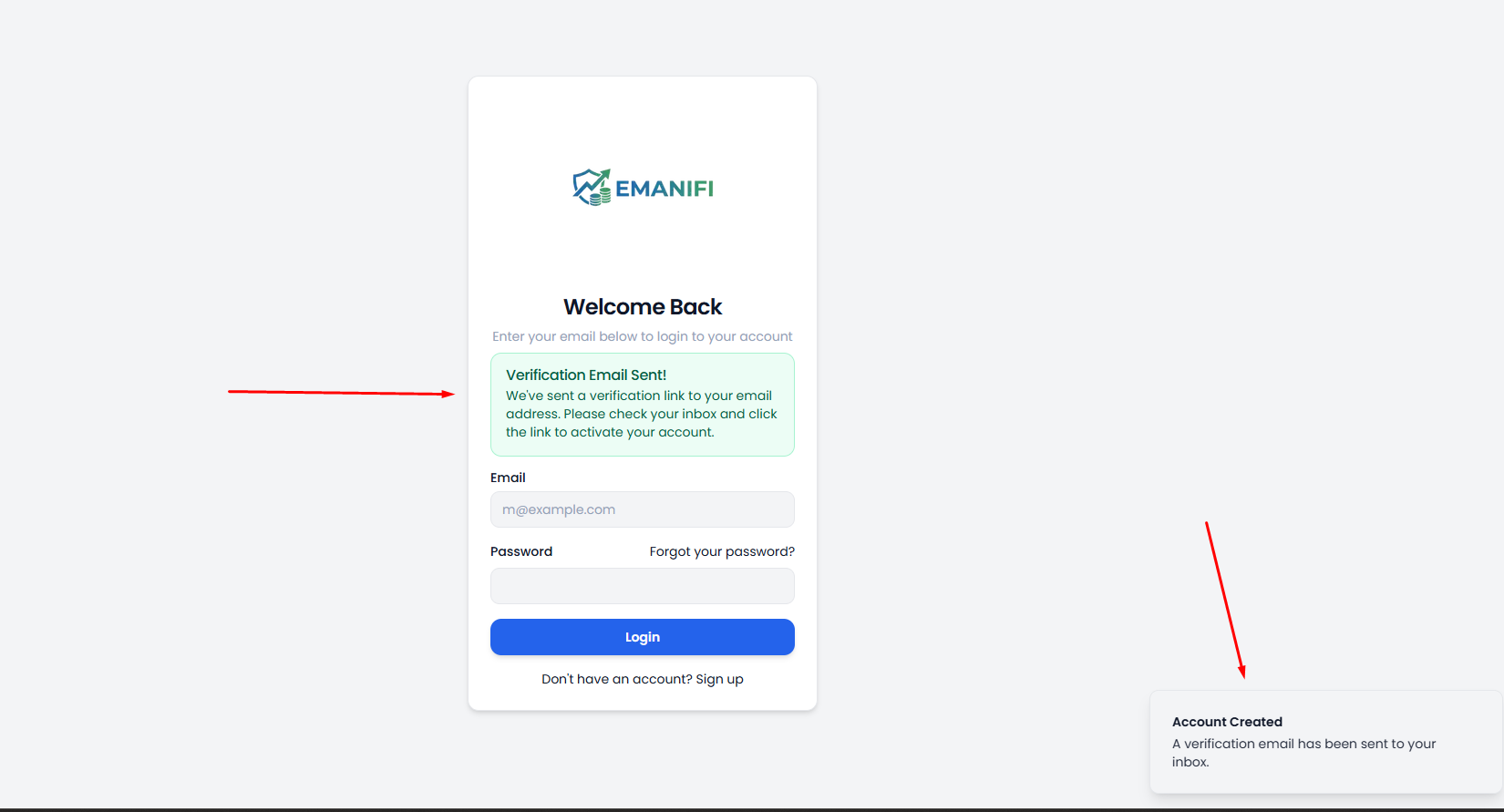

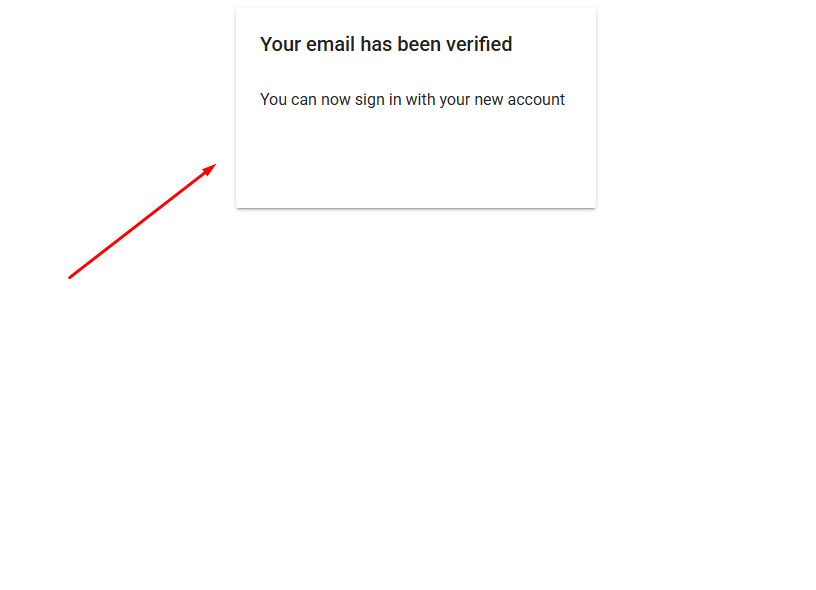

Account Verification

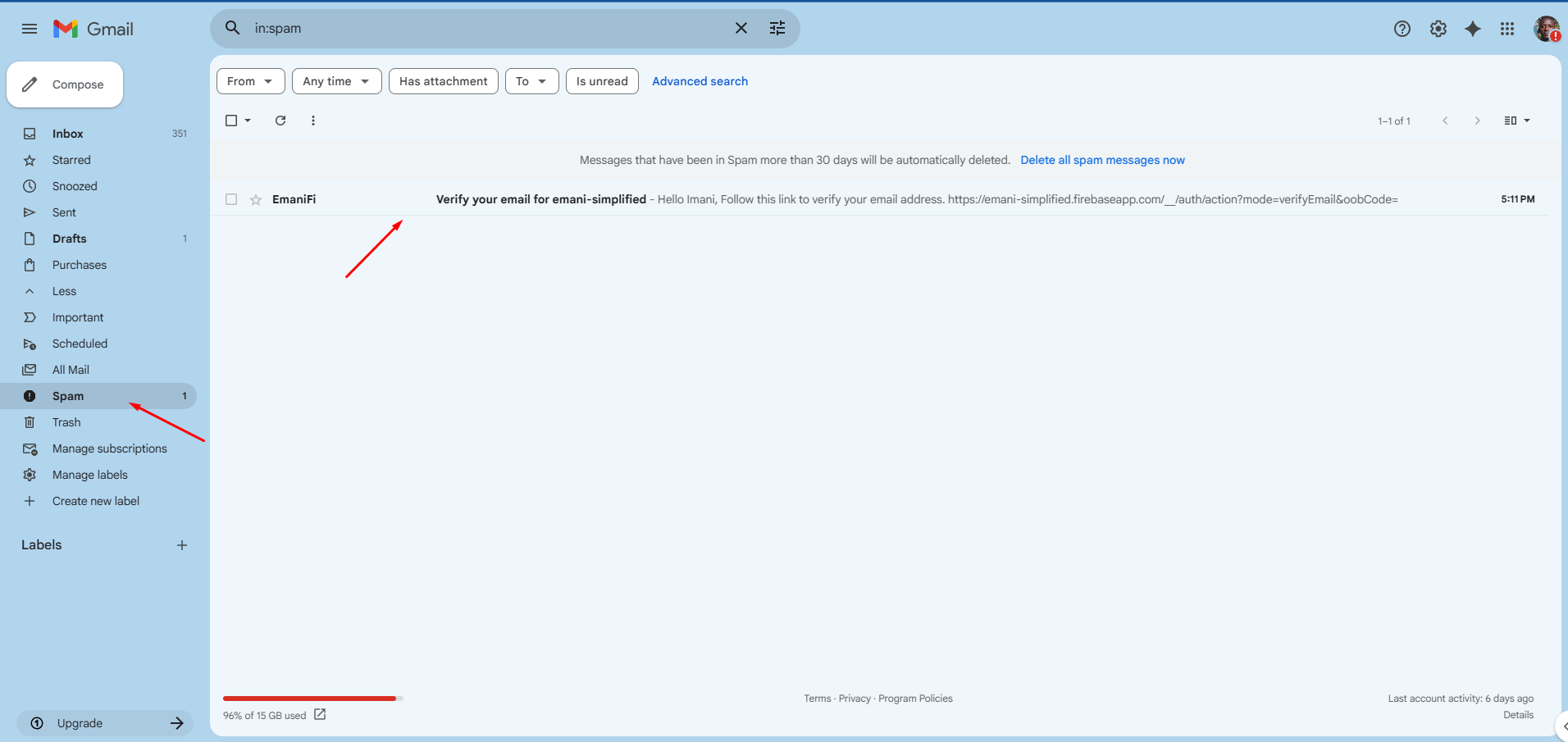

After signing up, check your email inbox for a verification link sent by EmaniFi.

Important Note

If you don't see the email in your Inbox within a few minutes, please check your Spam or Junk folder.

Account Creation

Once your email is verified, you will be directed back to the site to complete your profile setup.

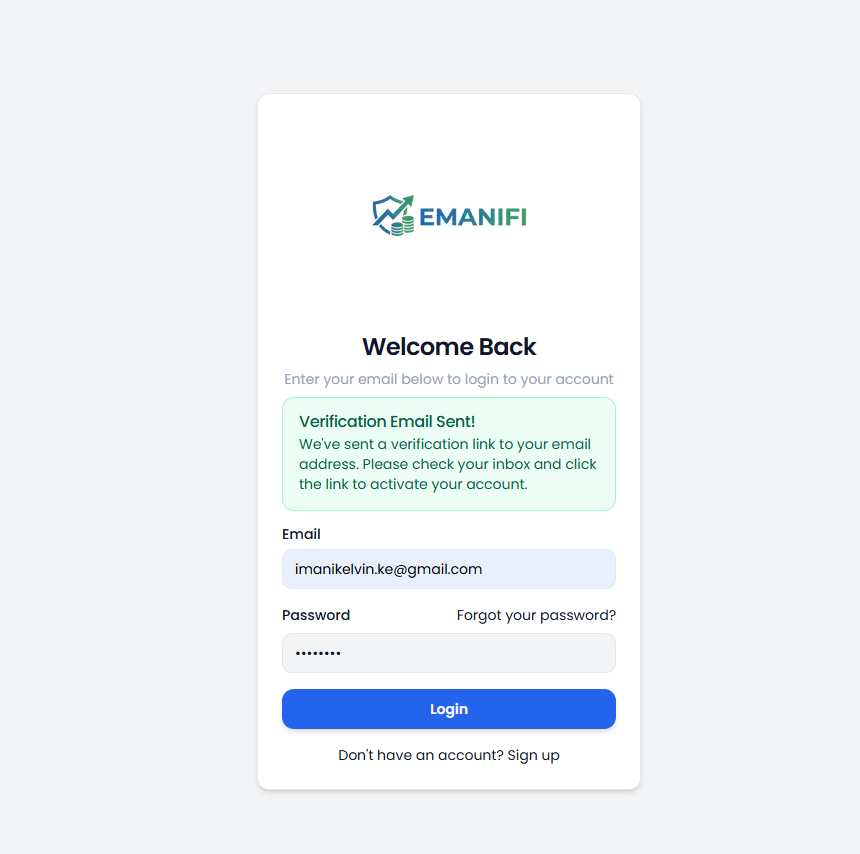

Log In

You are now ready to log in! Enter your credentials to access your secure financial workspace.

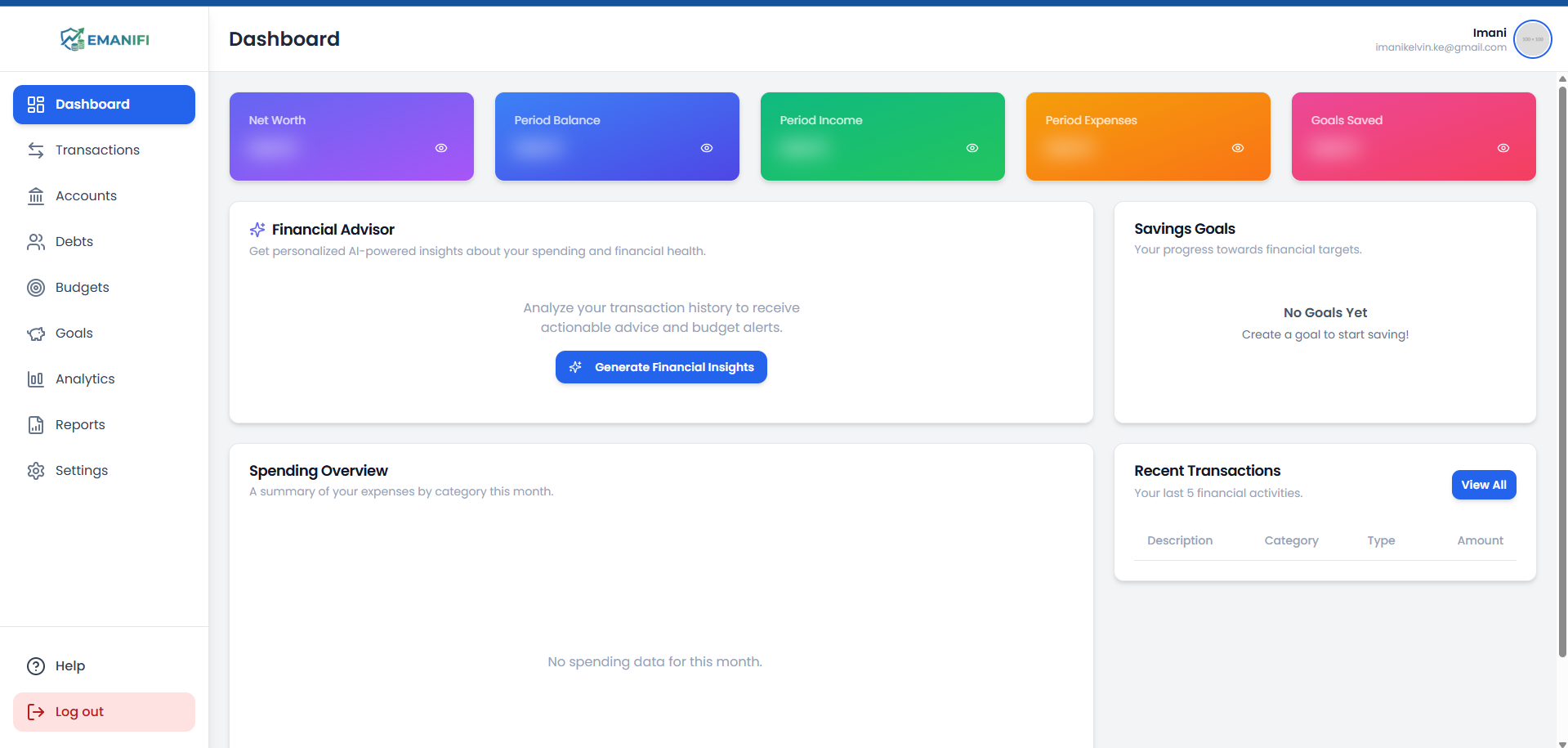

Your Dashboard

Welcome to your central hub for family finance. From here, you have a complete overview of your household's financial health:

-

Net Worth & Goal Progress

-

Income & Expense Tracking

-

Budgets with Auto-Alerts

-

Debt & IOU Management

Family Dashboard Overview

Quick stats, net worth calculations, and recent activity.

Detailed Analytics

Deep dive into spending habits and goal contributions.

More Than Just Tracking

Discover the powerful features designed to give your family financial clarity without the bank involvement.

Smart AI Categorization

Log transactions faster. Our AI-powered tool suggests relevant categories for your spending, making manual logging accurate and effortless.

Debt & IOU Manager

Keep track of everything. A dedicated module manages money you've borrowed (liabilities) and money others owe you (receivables).

Private & Offline-First

No bank connections, no chaos. Your data is private, manually tracked, and organized for clarity without compromising security.

Collaborative Goals

Create savings goals and watch your progress update automatically as you contribute. Make money decisions together as a family.